Forex Pips Definition. PIPs stands for percentage in point. It’s difficult to overestimate the value of pips while trading in the foreign exchange (FX) market. The basic movement a currency pair might make in the market is represented by a pip, which stands for either “percentage in point” or “price interest point.” A pip is equivalent to 1/100 of a percentage point, or one basis point, in most currency pairs, such as the British pound/US dollar (GBP/USD), and pips are tallied in the fourth place after the decimal in price quotes. A pip is one percentage point in currency pairs involving the Japanese yen, and pips are counted after the decimal in price quotes.

To facilitate international trade and business, currencies must be exchanged. Such transactions, as well as wagers made by speculators hoping to profit from price movements in pairs of currencies, take place in the currency market. Pips are used to calculate the rates that forex market players pay when trading currencies.

Important Notes About Pips

- In the forex market, pips (percentage in point) are used to compute the rates that traders will pay.

- The value is determined by the trader’s lot size (1,000 vs. 100,000 units, say.)

- The pip value is determined by the currency used to open the account.

- Brokers profit on the pips difference between the price a seller receives and the price a buyer pays.

Pips, Pipettes, and Spreads

When trading, the value of the pips for your deal can change based on your lot size. (A regular lot is 100,000 units, a mini lot is 10,000 units, and a micro lot is 1,000 units of a currency.)

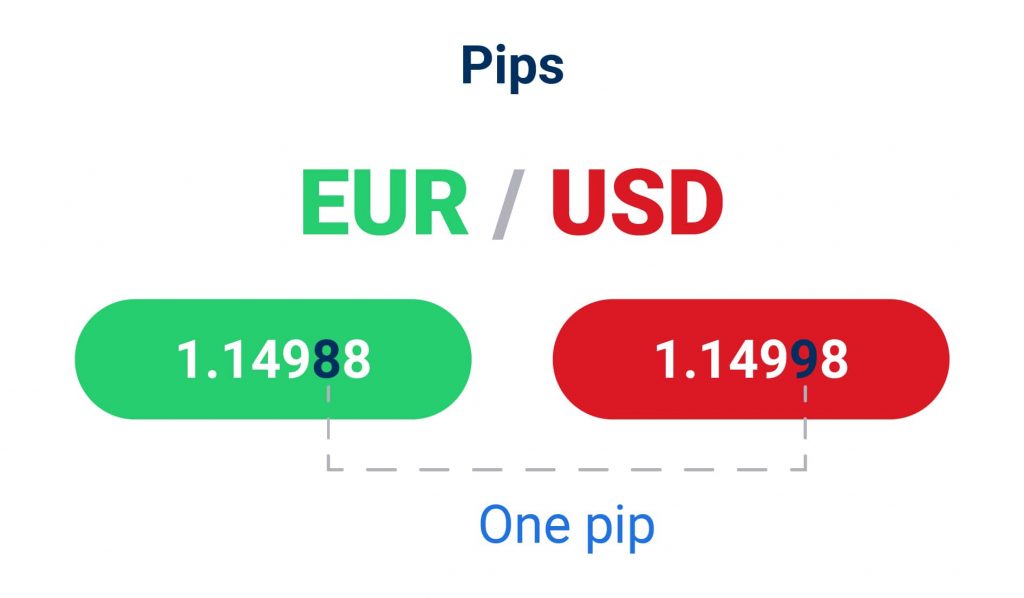

The spread is the number of pips between the bid price (which is what the seller receives) and the ask price (which is what the buyer pays). Because most forex brokers do not charge commissions on individual trades, the spread is essentially how your broker makes money. When you buy at the ask price (say, 0.9714) and sell at the bid price (say, 0.9711), the spread is kept by the broker (3 pips).

After a pip, several forex brokers quote rates to one decimal point. Pipettes are pips divisions that provide for greater flexibility in pricing and spreads.

Pip Values for U.S. Dollar Accounts

The pip value of many currency pairings is determined by the currency you choose when opening your forex trading account. If you open an account in US dollars, the pip value for currency pairs where the US dollar is the second, or quote, currency will be $10 for a regular lot, $1 for a mini lot, and $0.10 for a micro lot. Only if the value of the US dollar rose or declined significantly—by more than 10%—would those pip values alter.

If your account is funded in US dollars, but the dollar isn’t the quote currency, you’d divide the customary pip value by the dollar-to-quote-currency exchange rate. The pip value for a regular lot is $7.51 ($10 / 1.3319), for example, if the US dollar/Canadian dollar (USD/CAD) conversion rate is 1.33119.

Value of Pip for Other Account Currencies

When a currency other than the US dollar is used to fund your account, the same pip value amounts apply when that currency is used as the quote currency. When the euro is the second currency in the pair, the pip value for a euro-denominated account will be 10 euros for a normal lot, 1 euro for a mini lot, and 0.10 euro for a micro lot. You would split the customary pip value by the exchange rate between the euro and the quote currency for pairs where the euro isn’t the quote currency.

Pip Movements in Trades

Let’s imagine you’re trading the euro against the British pound (EUR/GBP), and the bid and ask prices are 0.8881 and 0.8884, respectively. You anticipate a rise in the value of the euro against the pound, so you purchase a typical lot of euros at the ask price of 0.8884. The bid price is 0.8892 and the ask price is 0.8894 later in the trading day. You sell at the 0.8892 bid price. You made an 8-pip gain. You made 80 pounds on the trade if your account was funded with pounds.